The Euro, the common European currency, was bound to fail. One can not bind together nations with totally different economic system, with totally different citizen’s attitudes into one Union. While Germany kept fiscal discipline (well, relatively), German Unions and German workers kept moderation, while other countries took advantage of cheap credit and stable currency and incurred huge debts and huge salary increases like there is no tomorrow. The salaries in the crisis countries are much higher than, for example, in Germany. So underpaid German workers now will bail out the highly paid Greek workers, that have more vacation and retire earlier?

The bail out favors banks, who earn high risk premiums on interest, while the government assumes risk and buys bad credit. All this in violation of the EU no bailout clause. And giving financial incentive for risky behavior by banks.

Greece should have been allowed to go bankrupt. That is market economy. Let someone else buy the failed banks and continue running them. Let the bank managers be arrested for doing unsound business. The bank must not loan money that can not be repaid.

- Additionally, every nation in the world, including Germany and the USA, have too high a debt.

- And that a system based on compounded interest can not work in the long run ( 1 cent with 4% interest yield in 2000 years $0.01 * 1.04^2000= 1.16594643150219980412675240849 e+32= $ 1165946431502199804126752408490

One should start asking questions why countries can not be run without resorting to debt.

Human-Stupidity is just giving food for thoughts. We are just pointing to the stupidity that might ruin entire populations.

World currencies, country finances, world economy is seriously stupid, based on stupid belief, based on greed of banks, politicians, and yes, the normal citizen who wants his benefits now, on loaned money.

Countries should repay loaned money in times of strong economy. Not increase loans more and more. That is Keynesian economics.

Spiegel Online International: Top Economist on the Euro Crisis; ‘

The German Government Will Pay Up’, June 27, 2011

In a SPIEGEL interview, leading German economist Stefan Homburg argues that euro-zone members should not bail out Greece, discusses who is making a profit from the crisis and explains why he himself is buying Greek bonds. "I believe in the boundless stupidity of the German government," he says.

More related articles

- ‘Clinging to the Euro Will Only Prolong the Agony’

- Time for Plan B: How the Euro Became Europe’s Greatest Threat

- Bad for Business: Euro Crisis Has Decimated Greek Private Sector

All quotes from :

Spiegel Online International: Top Economist on the Euro Crisis; ‘The German Government Will Pay Up’, June 27, 2011

In a market economy, even in the case of a plumber whose customers don’t pay their bills, it’s never a question of getting creditors "involved" (in helping to deal with a bankruptcy). Instead, when push comes to shove, it is creditors, and creditors alone, who have to write off their loans. Only then do they have an incentive to carefully choose who they lend money to. A market economy with no personal liability cannot function. The government bailout initiatives create misdirected incentives that continuously exacerbate the problems on the financial markets.

Wait, there is more! This article continues! Continue reading “Trillions to save the Euro? World currencies, a house of cards!” »

Trillions to save the Euro? World currencies, a house of cards!

» continues here »

The rest of them, all of them, got off. Not a single executive who ran the companies that cooked up and cashed in on the phony financial boom — an industrywide scam that involved the mass sale of mismarked, fraudulent mortgage-backed securities — has ever been convicted.

The rest of them, all of them, got off. Not a single executive who ran the companies that cooked up and cashed in on the phony financial boom — an industrywide scam that involved the mass sale of mismarked, fraudulent mortgage-backed securities — has ever been convicted.

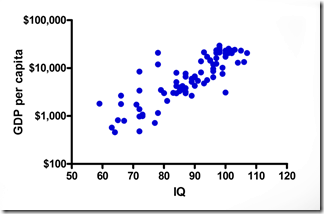

IQ and the Wealth of Nations by Richard Lynn $102.95 027597510X

IQ and the Wealth of Nations by Richard Lynn $102.95 027597510X