Germany has, tacitly and automatically, already loaned € 547 Billions to Southern European countries. Add to this the hundreds of Billions in bonds the European Central Bank already bought, in violation of their charter. Germany is responsible for 27% of all these. For more if other guarantors fail to pay. In addition to Germany being a net payer for the EC budget, year by year, to aid moneys to weaker countries. Plus German guarantees for Greek and other bonds that probably will never be paid.back.

Germany has, tacitly and automatically, already loaned € 547 Billions to Southern European countries. Add to this the hundreds of Billions in bonds the European Central Bank already bought, in violation of their charter. Germany is responsible for 27% of all these. For more if other guarantors fail to pay. In addition to Germany being a net payer for the EC budget, year by year, to aid moneys to weaker countries. Plus German guarantees for Greek and other bonds that probably will never be paid.back.

Most significantly for German public opinion, Weidmann’s message spoke about possible losses for the Eurosystem of member-country central banks caused by growing internal imbalances among European central banks generated by capital flight from southern EMU members. Weidmann’s letter, which found its way into the columns of the conservative Frankfurter Allgemeine Zeitung newspaper, appeared to suggest more secure collateralization for the overall ECB credits to weaker EMU central banks, which now amount to more than €800 billion under the ECB’s Target-2 electronic payment system.

The latest Bundesbank figures show that the Bundesbank’s share of these credits rose from €498 billion to €547 billion in February, pointing to continued capital flight from the southern to the northern members of EMU. Weidmann reawakens debate on Bundesbank’s power

The German Bundesbank is owed € 547 Billion in target claims the European Central Bank. This is € 13,000 Euro per employed German.

Our life insurance policies and savings accounts now are owed more than 13,000 € per German worker from open target claims against the other central banks in the euro zone. These demands can not be made due, get an interest rate below inflation, and will prove to be wholly or partially worthless, if the Euro breaks or if Euro countries go bankrupt. 2

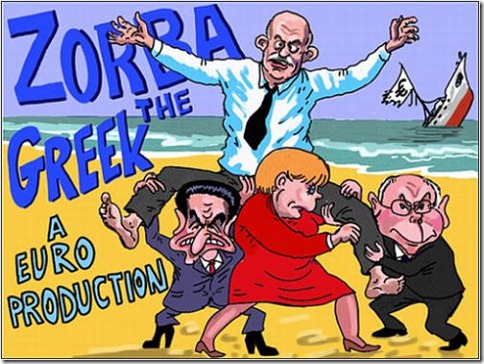

The world blames Germany for attaching conditions to loaning or rather giving away money they legally should never give in the first place. The world wants Germany to bail out all of Europe, to give enormous guarantees that some day might become due as true financial liabilities for Germany. Risk Germany’s bankruptcy to bail out Europe.

The world blames Germany for attaching conditions to loaning or rather giving away money they legally should never give in the first place. The world wants Germany to bail out all of Europe, to give enormous guarantees that some day might become due as true financial liabilities for Germany. Risk Germany’s bankruptcy to bail out Europe.

Saving the Euro

Germany’s Central Bank against the World

Jens Weidmann, the new president of Germany’s Bundesbank, is strongly opposed to making the European Central Bank the lender of last resort in efforts to prop up the common currency. It’s a lonely fight, however, and the pressure from Germany’s European partners is intense. Some warn that Weidmann’s course could end up destroying the euro. By SPIEGEL Staff.

Hasn’t the Euro already been destroyed by insane spending and borrowing? World wide, governments borrow money with no intent to ever pay it back. Rather they pay it with the next loan.

And then they are unable to afford the new loan because the interest increased. This is not unexpected, it has caused insolvency in Latin America 20 years ago.

Wait, there is more! This article continues! Continue reading “Germany’s Central Bank against the World of unlimited money printing” »

Germany’s Central Bank against the World of unlimited money …

» continues here »

The Southern European countries have a different pay and work ethic then Northern European countries. Southern Europeans strike more for wage increases, for lower work hours and earlier retirement. They use more borrowed money, like there is no tomorrow, for instant gratification. Maybe it makes the Southerners happier and more humane then the Northern European work animals. The northern countries have more self discipline, work ethic, self sacrifice.

The Southern European countries have a different pay and work ethic then Northern European countries. Southern Europeans strike more for wage increases, for lower work hours and earlier retirement. They use more borrowed money, like there is no tomorrow, for instant gratification. Maybe it makes the Southerners happier and more humane then the Northern European work animals. The northern countries have more self discipline, work ethic, self sacrifice.