Different work ethics and morals cause different monetary politics, and make Northern and Southern European economic policies incompatible. Transfer Unions between West and East Germany, Northern and Southern Italy have only wasted money. Bailout attempts will spread bankruptcy to healthy countries. Germany would be the last to fail under the debt of all of Europe. USA and Switzerland function perfectly with clear no-bailout policies towards their states and cities.

In Northern Europe, culture, quite aside from the law, supplies a sin and guilt control mechanism. We have set rules for moral and ethical behaviour which we expect everyone to adhere to. The core value of a need to achieve is a stimulus for entrepreneurship and economic development. It is our psychological mainspring. Governments build their policies around this fundamental core value which affects the entire socio-cultural system. The Swedes ‘carry Luther on their shoulders’ and believe they need to do a good day’s work before they can partake in any reward – as do all the Nordic countries. Success equals personal achievement, the drive to get things done, and accumulating capital to gain status and wealth.

In Southern Europe, shame tends to be the control mechanism, with one’s relationship to other people and to the group determining acceptable behaviour. Ethics is more related to the situation and who is involved, so ‘rules’ as we perceive them are often ‘broken’. Style is everything; manliness (machismo) counts and should be displayed; dignity and honour must be maintained. The Cultural Value of “The Public Man” is the desire to be someone rather than do something.Success equals social power; being someone personally important, being surrounded by people who look up to you and are dependent on you.

Just across the Channel and beyond, being who you are counts for more than what you have achieved; security comes not from individual effort but from reciprocal relationships which mould your expectations of lifestyle and your place in society. Friendships are formal and a great amount of time is given to nurturing these. Large, extended families, including distant blood relatives and close family friends, are the norm which have strong emotional ties, giving a powerful commitment to family rather than the rest of the world. Taxi drivers and hotel receptionists often try and impress upon us, the foreigner, how well connected they are to give themselves status.

In cultures like these, WORK per sé holds little value and is to be avoided if possible.Developing friends and connections is THE form of capital investment – not ‘personal development’ as we know it in the UK. The genteel pursuit of leisure gives status – not the image of industriousness and efficiency as in the North. 3

Different Ethics, incompatible financial and economic attitudes

The Southern European countries have a different pay and work ethic then Northern European countries. Southern Europeans strike more for wage increases, for lower work hours and earlier retirement. They use more borrowed money, like there is no tomorrow, for instant gratification. Maybe it makes the Southerners happier and more humane then the Northern European work animals. The northern countries have more self discipline, work ethic, self sacrifice.

The Southern European countries have a different pay and work ethic then Northern European countries. Southern Europeans strike more for wage increases, for lower work hours and earlier retirement. They use more borrowed money, like there is no tomorrow, for instant gratification. Maybe it makes the Southerners happier and more humane then the Northern European work animals. The northern countries have more self discipline, work ethic, self sacrifice.

Historically, before the Euro, the southern European currencies regularly suffered devaluations to re-instate an equilibrium. Now putting these countries into one currency simply leads to Southern Europe having too high salaries, too high cost, and being too uncompetitive. These are not the countries where all citizens voluntarily lower salaries, and happily increase work hours and retirement age.

Spain Labor Market Incompatible With Euro

Well, reading thru Op-Ed pieces in the New York Times I came across a short piece by U Maryland economist Gayle Allard who explains a core problem with Spain’s economy as a member of the Euro: The country needs periodic bouts of inflation to undo the distortions caused by very powerful unions. This makes Spain’s entry into the euro zone an act of enormous political folly for all involved.

While it was doing its fiscal homework, however, Spain overlooked a key requirement for the currency area: staying competitive without a national exchange rate. Spanish labor costs chronically rise much faster than productivity.

Spain needs bouts of inflation as long as collective bargaining remains highly politicized. A country that needs periodic bouts of inflation should not share a currency with Germany. One doesn’t need to be a rocket scientist running complex computer models to figure that out.

No state and city bailout in USA and Switzerland. No major transfer Unions

In the USA, cities and states are totally responsible for their budget and will not be bailed out by other government entities. If there is a disequilibrium, citizens always have the option to migrate to other states. A single language and culture in the US is helpful. Switzerland is similar, no bailouts.

In the alternative model to a German-style transfer union, ordinary people have to shoulder most of the adjustment burden. In the United States, for example, workers are much more willing to move to other states for better-paying jobs than in Europe, although this is also greatly facilitated by the fact that the whole country speaks the same language.

As a result, economic imbalances are reduced relatively quickly within the US, thus limiting the need for intervention by the federal government. There are, of course, federal taxes and targeted regional aid programs coming from Washington. The large-scale social welfare programs for retired people (Medicare) and the poor (Medicaid) also help to soften economic tensions. But there is no such thing as a redistribution of wealth based on the German model of financial transfers among states. Oxford-based economist Clemens Fuest explains the system by referring to what he calls the typically American "aversion to government."

The notion that individual states could attempt to pass on their unsustainable mountains of debt to the community, as is the case in Europe, is also unthinkable in the United States. In the last 170 years, federal and state governments have only assumed the debts of cities and other municipalities in exceptional cases, as a study by US economist Robert Inman concludes. In 1997, the US government rescued the over-indebted capital Washington from bankruptcy, and since 2002, the New Jersey state government has been helping out the cash-strapped port city of Camden.

Otherwise, a strict ban on government being held liable for others’ debt applies in the United States, not unlike the corresponding clause in the EU’s Maastricht Treaty. In the United States, state and local governments that cannot manage their money effectively cannot expect financial support from Washington or a state capital. When the cash-strapped state of Minnesota became insolvent a few weeks ago, no bailout fund was established to save it. Instead, the state government closed many government agencies, shut down many public works projects and sent two-thirds of government workers on unpaid vacations. USA

EU bailout in violation of no-bailout clause

EU bailout in violation of no-bailout clause

Now in violation of the European Union’s no-bailout clause, countries get bailed out. Indiscipline gets rewarded.

In Germany, there is a crime called "Insolvenzverschleppung" (failure to file bankruptcy) that increases losses more then necessary). So Greece and other countries can continue the party a little more, while Germany and other countries take responsibility for the debt. In the very long run this could bankrupt even Germany, if they are responsible for everyone else’s debt. This way a Greek and Portuguese crisis finally becomes a Euro crisis, bankrupting Europe as a whole.

This is similar to the tragedy of the commons. Or if you give your kids an unlimited cell phone, but you pay the bill. Why would they suffer inconveniences and restrict their phone usage?

Of course, this is aggravated by the fact that even Germany does not obey the EU clauses of maximum 60% GDP debt and 3% GDB yearly deficit. Even Germany and the US borrow like there is no tomorrow, with no intent to ever pay back the debt at due date. The entire borrowing culture, welfare and retirement benefit industries are problematic in themselves.

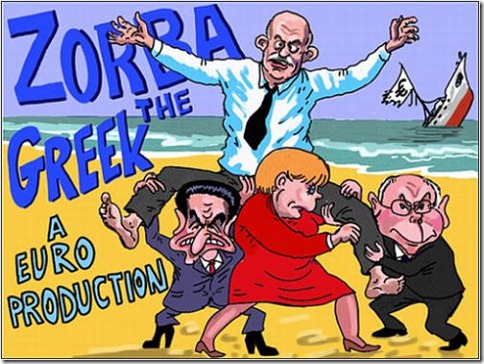

And now the EU wants to set up new rules and agreements. The same EU who blatantly ignored the earlier rules and agreements. In exchange for money for Greece, the Northerners want to force the happy-go-lucky southern countries to become disciplined and hard working like Germans. This leads to riots, strikes and mayhem. Greeks don’t want to live and work like Germans. And Germans don’t want work even harder to pay debt of the Greek who have more vacation, retire earlier, and have higher salaries. And Greek vacation hotels priced themselves out of the market. A devaluation would fill the nice Greek islands with tourists immediately.

It would have been better had the old European governments left the old currencies and installed a non-profit currency exchange and currency future trading institution. They would try to keep exchange rates constant, but not at all cost. The same rules and same currency with different character and attitudes, this does not work.

We don’t want no transfer union. Tight-fisted Germans resent paying for profligate Greeks, Irish and others

There is more than a grain of truth in this. Germans were loth to give up the D-mark in 1999 and have never warmed to the euro. In 2008, some 56% of Germans wanted the mark back, according to Allensbach, a pollster. Despite the panic about Greece, that share was down to 47% in April, but only a third of Germans had “great faith” in the euro. Mrs Merkel, whose coalition government has so far disappointed voters, wins plaudits when she takes a tough line against errant euro members and scorn when she seems soft. Her Christian Democrats fear that a demagogic D-mark party might emerge to steal votes.

German behaviour is guided by more than petty politics. In adopting the euro the Germans thought they were joining a condominium, in which every member would keep order on their own property, and not a messy commune. Now the crisis threatens that understanding. The Greek bail-out and the €750 billion ($980 billion) war chest created in May to defend the euro look to many Germans like a violation of the “no-bail-out clause” in the Maastricht treaty that created the euro. The government insists it is not, because the aid is voluntary and temporary. The constitutional court is evaluating this claim. The proposed successor, a permanent facility plus procedures to impose losses on creditors of insolvent countries, needs a treaty revision to pass constitutional muster.

The official start of the European transfer union

The possibility of financing through the EFSF reduces the pressure for countries to eliminate deficits and reduce government debts. Why introduce harsh austerity measures, reform labor markets and privatize the public sector if there are loans available from the EFSF at ridiculously low interest rates? If you want to win elections, you should not reform but spend. Only through deficit spending one can maintain the artificially high living standards in the periphery. Indeed, debts are still on the rise. Deficits are huge and far from being eliminated. Most probably, Greece, Ireland, Portugal and soon Spain, Italy and even Belgium will borrow exclusively from the EFSF. To be effective, the size of the EFSF will have to be extended. The main guarantor will be Germany. Considering peripheral funding needs, a report fromBernstein calculates:

As the guarantees of the periphery including Italy are worthless, the guarantee Germany would have to provide rises to €790bn or 32% of GDP.

If France is downgraded, the German share increases to €1.385 trillion —56% of GDP.

The transfer union implies a transfer of power to the European Commission. We get ever closer to a European superstate. Incentives to reduce deficits will be reduced both in the periphery and in the core. Germans will start to resist cuts in public spending. Why save if the savings flow to the periphery? Instead of reducing German pensions to guarantee Greek pensions, German voters will push for more public spending. To pay for welfare states and transfers, more taxes (maybe a European tax) and money production will become necessary. The centralization of power allows for harmonization of regulations and taxes. Once tax competition ends, there will be a tendency towards ever higher taxes. With the transfers, the power of Brussels will continue to rise. There seems to be only one bold, albeit costly way, to stop the process towards a EUSSR: withdrawal from the transfer union. With an exit from the Euro, Germany could bring down the whole Euro project and save Europe.

In the USA, from the period of dot com bust, till date, the political class and their henchmen in the Fed, have created bubble after bubble by borrowing and injecting liquidity in the system. There was no job growth, no real income growth, only an illusion of prosperity, created by simply inflating asset prices. Stock markets went up and up, house prices went higher forever, fooling the mass that they are far wealthier and they need not save or produce anything. Only one country in the western world has bucked this trend. That country is Germany. But there also they were fooled by megalomaniac politicians, notable among them Mr. Helmut Kohl. Helmut Kohl, a post world war 2 politician, who grew up in the guilt of wars, wanted to become a world statesman and thus pushed for the creation of a unified Europe and Euro. While Euro has helped German export machinery to a great extent, it has also tied Germany to other profligate countries in Europe and its periphery that do not have the fiscal or work ethics of Germany. 2

Tyler Cowen Asks If Euro End Is Near

I am seeing reports of 7.7 on the Italian ten-year bond, over eight percent on the two-year bond, 6.5 percent on the six-month note, and so on. Here is one account.

South America has similar problems. Argentina went into total recession by pegging their Peso to the US dollar. Argentina also defaulted on debt and still is part of the international community. Argentina and Brazil got ruined when interests rose sharply a few decades ago. Nothing new under the sun.

Banks have to pay for their risks. And as long as countries can borrow money, they have to be solely responsible for their decisions, and for the interest the market requires of them.

Article 103 says that: the Union shall not be liable for or assume the commitments of central governments.

This article was specially written to leave ensure no EU country would be saved by the EU if it doesn’t respect the Union’s economic rules. And that’s precisely the case in Greece. ‘No Bailout’ Clause? The EU’s Greek Rescue Problems

Literature

- No to transfer Union, for a stable currency (German) is a great 90 page article explaining the entire situation very concisely. Unfortunately in German. Nein zur Transfer Union Web Site

- Germany is the real winner in a transfer union | Financial Times. We at Human Stupidity disagree ….

- A European transfer union. How large, how powerful, how expensive?

- The Eurozone is already a transfer union

Designing a Transfer Union to Save the Euro

The example of the states of the former East Germany, however, shows that a political union can sometimes even amplify existing economic imbalances. Instead of seeking a way out of their economic crisis, some poverty-stricken regions might prefer to become permanent subsidy recipients. […]

Italy and Belgium were already divided economies when they had their own currencies. But the tensions have only increased since the euro was introduced. In Belgium, the struggle over the capital Brussels is the only thing preventing the two mutually antagonistic parts of the country from splitting apart. And in Italy, where the right-wing Northern League defends northern Italian interests, a party representing the south has also now been formed. It sees its main objective in liberating the poorer parts of the country from "northern Italian oppression."

The American System of Individual Responsibility

What Europe can learn from the experiences of other currency areas is obvious. A viable transfer union for the euro zone cannot be modeled after the systems of centralist countries like France or Sweden, warns Berlin-based economist Henrik Enderlein. The right model for the continent, says Enderlein, is a "competitive federalism" resembling the systems in Switzerland and the United States. The individual states are largely autonomous in making decisions on income and expenditures, while low federal taxes and a central unemployment insurance provide for a minimum of financial equalization.

Most of all, however, the individual states remain responsible for their debts. Those that mismanage their finances must face the consequences, including higher taxes and the possibility of bankruptcy, by themselves.

Help from the community can only be provided if it is tied to strict conditions and is monitored by a nongovernmental organization like the IMF. Countries that can no longer service their loans must turn over their national sovereignty to a European austerity commissioner — or file for bankruptcy. The German system of redistribution of income among federal, state and local governments is "not a model for Europe," says economist Enderlein.

Remembered clearly and obviously still viable is the Nazi approach.

You are right of course, there should be no bailout. But the real reasons for Greece being offered a bailout have names : Commerzbank, Deutsche Bank, Société Générale, BNP Paris-Bas. All these players are up to their ears in Greek bonds. If it were not for this, Merkel and Sarkozy would let Greece sink.

“And Germans don’t want work even harder to pay debt of the Greek who have more vacation, retire earlier, and have higher salaries.”

This sounds a lot like nonsense. Can you please find me some statistics showing me that Greeks have higher salaries than Germans, or take longer holidays? The truth is that workers in Italy, Spain and Greece do NOT work shorter hours, earn more or retire earlier than workers in Germany or Holland. It is entirely untrue. If those countries’ economy is not as strong, it is not because the wokers there enjoy more rights. It’s also not true that the unions are stronger in those countries.

I believe this to be true. I wish someone linked to profound studies on this.

Fact is, though, that in the remote past, Italy, Greece etc were CHEAP vacation countries where Germans were drawn to for low prices. This was due to lower productivity and other reasons that depressed the free marked value of their currency. And this mechanism is gone.

They also paid higher interest on credit, thus discouraging borrowing too much money.

I have seen stastics which prove that Greeks work the longest hours within the EU. They also most definitely get lower salaries.

“In Southern Europe, shame tends to be the control mechanism, with one’s relationship to other people and to the group determining acceptable behaviour. Ethics is more related to the situation and who is involved, so ‘rules’ as we perceive them are often ‘broken’. Style is everything; manliness (machismo) counts and should be displayed; dignity and honour must be maintained. The Cultural Value of “The Public Man” is the desire to be someone rather than do something.Success equals social power; being someone personally important, being surrounded by people who look up to you and are dependent on you.”

This description of “South European” cultures clearly comes from an outsider, and is not one that people in those countries would subscribe to. In particular the part on style, machismo and dignity and honour is very stereotypical and old-fashioned.

By the way, while style may be important in Italian culture, the Spanish are far less interested in their clothes and appearance. And words like “dignity” and “honour” count for no more in Mediterranean countries than they do in Northern Europe, at least nowadays.