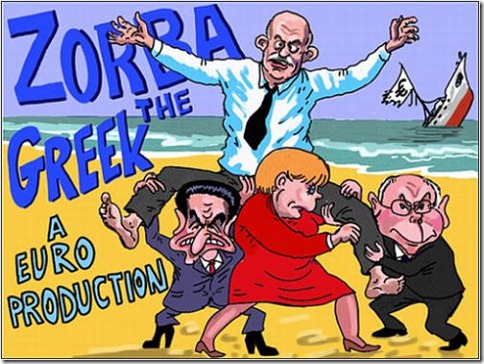

Different work ethics and morals cause different monetary politics, and make Northern and Southern European economic policies incompatible. Transfer Unions between West and East Germany, Northern and Southern Italy have only wasted money. Bailout attempts will spread bankruptcy to healthy countries. Germany would be the last to fail under the debt of all of Europe. USA and Switzerland function perfectly with clear no-bailout policies towards their states and cities.

In Northern Europe, culture, quite aside from the law, supplies a sin and guilt control mechanism. We have set rules for moral and ethical behaviour which we expect everyone to adhere to. The core value of a need to achieve is a stimulus for entrepreneurship and economic development. It is our psychological mainspring. Governments build their policies around this fundamental core value which affects the entire socio-cultural system. The Swedes ‘carry Luther on their shoulders’ and believe they need to do a good day’s work before they can partake in any reward – as do all the Nordic countries. Success equals personal achievement, the drive to get things done, and accumulating capital to gain status and wealth.

In Southern Europe, shame tends to be the control mechanism, with one’s relationship to other people and to the group determining acceptable behaviour. Ethics is more related to the situation and who is involved, so ‘rules’ as we perceive them are often ‘broken’. Style is everything; manliness (machismo) counts and should be displayed; dignity and honour must be maintained. The Cultural Value of “The Public Man” is the desire to be someone rather than do something.Success equals social power; being someone personally important, being surrounded by people who look up to you and are dependent on you.

Just across the Channel and beyond, being who you are counts for more than what you have achieved; security comes not from individual effort but from reciprocal relationships which mould your expectations of lifestyle and your place in society. Friendships are formal and a great amount of time is given to nurturing these. Large, extended families, including distant blood relatives and close family friends, are the norm which have strong emotional ties, giving a powerful commitment to family rather than the rest of the world. Taxi drivers and hotel receptionists often try and impress upon us, the foreigner, how well connected they are to give themselves status.

In cultures like these, WORK per sé holds little value and is to be avoided if possible.Developing friends and connections is THE form of capital investment – not ‘personal development’ as we know it in the UK. The genteel pursuit of leisure gives status – not the image of industriousness and efficiency as in the North. 3

Different Ethics, incompatible financial and economic attitudes

The Southern European countries have a different pay and work ethic then Northern European countries. Southern Europeans strike more for wage increases, for lower work hours and earlier retirement. They use more borrowed money, like there is no tomorrow, for instant gratification. Maybe it makes the Southerners happier and more humane then the Northern European work animals. The northern countries have more self discipline, work ethic, self sacrifice.

The Southern European countries have a different pay and work ethic then Northern European countries. Southern Europeans strike more for wage increases, for lower work hours and earlier retirement. They use more borrowed money, like there is no tomorrow, for instant gratification. Maybe it makes the Southerners happier and more humane then the Northern European work animals. The northern countries have more self discipline, work ethic, self sacrifice.

Historically, before the Euro, the southern European currencies regularly suffered devaluations to re-instate an equilibrium. Now putting these countries into one currency simply leads to Southern Europe having too high salaries, too high cost, and being too uncompetitive. These are not the countries where all citizens voluntarily lower salaries, and happily increase work hours and retirement age.

Spain Labor Market Incompatible With Euro

Well, reading thru Op-Ed pieces in the New York Times I came across a short piece by U Maryland economist Gayle Allard who explains a core problem with Spain’s economy as a member of the Euro: The country needs periodic bouts of inflation to undo the distortions caused by very powerful unions. This makes Spain’s entry into the euro zone an act of enormous political folly for all involved.

While it was doing its fiscal homework, however, Spain overlooked a key requirement for the currency area: staying competitive without a national exchange rate. Spanish labor costs chronically rise much faster than productivity.

Spain needs bouts of inflation as long as collective bargaining remains highly politicized. A country that needs periodic bouts of inflation should not share a currency with Germany. One doesn’t need to be a rocket scientist running complex computer models to figure that out.

No state and city bailout in USA and Switzerland. No major transfer Unions

Wait, there is more! This article continues! Continue reading “No bailout! European differences in work ethic and culture can not be overcome by transfer union” »

No bailout! European differences in work ethic and culture can not…

» continues here »